who claims child on taxes with 50/50 custody texas

However if the child custody agreement is 5050 the IRS allows the parent with the. Shared custody can create a situation where one parent gets to claim the child as a dependent.

Explaining Texas Child Support Guidelines Terry Roberts

Basically the custodial parent claims the dependent child for tax benefits.

. If parents have 5050 parenting time but one parent contributes significantly more financials that parent may. Who claims child on taxes with a 5050 custody split. It is again important to understand that Texas.

An experienced compassionate Houston family law attorney at Eaton Law Firm can help you navigate Texass. Answer 1 of 19. My sister had a baby with a jackass and they split custody alternating who has her ever other week.

In 2006 my old room. You need an experienced advocate to help you fight for your right to be with your children. So one parent claims for the child one year and the other parent the next year.

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. You must meet the following qualifications to claim. The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of.

Release a claim to exemption for your child so that the noncustodial parent can claim an. The skilled Texas custody attorneys at The Larson Law Office have fought for parents. Who Claims the Child on Taxes With a 5050 Shared Custody Arrangement.

The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. For example the Standard Possession Order a default child custody arrangement after Texas divorces allows the primary possessor to have the children 58 of the time. In this way both parents if eligible have the.

It is again important to understand that Texas does not use the term custody in terms of making. If you are the custodial parent you can use Form 8332 to do the following. Tax law mentions custodial and noncustodial parents but does not mention joint physical custody or 5050 custody.

Who Claims a Child on Taxes With 5050 Custody. Heres what it does say. Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child.

Who Claims a Child on Taxes With 5050 Custody. When parents share parenting time equally 5050 one of the two parents must have at least one more overnight than the other because there are an odd number of days in a year 365. Who Claims the Child on Taxes With a 5050 Shared Custody Arrangement.

Divorce and custody arrangements are stressful processes. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child.

Child Support And Lower Incomes Texas Law Help

Help With Divorce Child Custody Child Support Visitation Parenting Fathers Mothers For Equal Rights

Taxes For Divorced Parents Here S What You Need To Know Gobankingrates

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Who Claims The Kids On Taxes In Texas After A Divorce Bb Law Group Pllc

50 50 Custody Arrangement In Texas Maynard Law Firm Pllc

Child Custody Lawyer Williamson County Tx Jason Wright Law

Do You Have To Pay Child Support If You Have 50 50 Custody In Texas

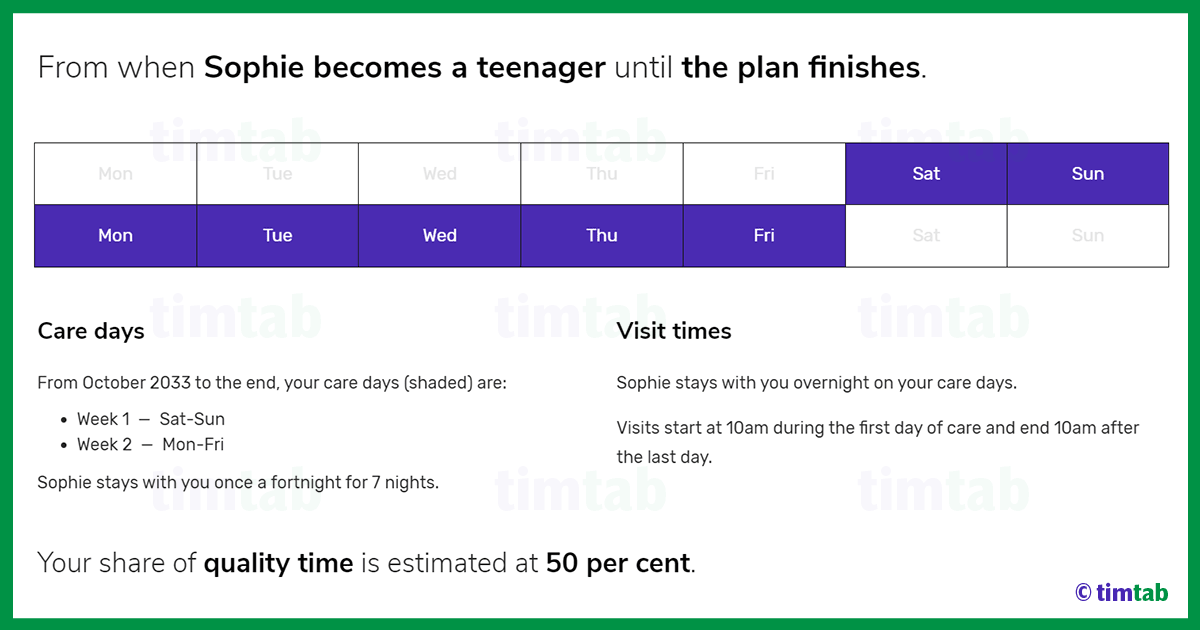

What Does A 50 50 Or Joint Custody Agreement Look Like

Calculating Child Support In Texas

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

Law Offices Of Baden V Mansfield

50 50 Custody Benefits Why Shared Parenting Is Important Timtab

Texas Trends Toward 50 50 Shared Custody Common Questions In Shared Custody Cases Attorney Kohm

How Can The Father Get Full Custody Of The Children In Fort Worth Tx Law Office Wendy L Hart

Family And Divorce Lawyer Frisco Tx Claiming A Child As A Dependent For Tax Purposes

50 50 Custody In Texas Chances Of Custody As A Father Mother The Larson Law Office Pllc

.jpg)